utah state food tax

As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice.

Counties and cities can charge an additional local sales tax of up to 24 for a.

. Food handling requirements throughout the state of Utah are laid out by the Utah Department of Health in rule R392-103. The state sales tax rate in Utah is 4850. With local taxes the total sales tax rate is between 6100 and 9050.

In the state of Utah the foods are subject to local taxes. Theres a 485 tax on prepared foods like what you get in a restaurant. Utah UT Sales Tax Rates by City.

State Budget PDF COBI. Utah Income Tax Line 22. We include these in their state sales tax.

The state sales tax rate in Utah is 4850. State Tax Deducted on Federal Form. Kristin Murphy Deseret News.

The full text of this rule is five pages long and covers all the requirements for getting a food handlers permit in Utah. The allowance rates listed below include tax and tips associated with the meals. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah.

Exact tax amount may vary for different items. State Tax Refund Included on Federal Return. Select the Utah city from the list of.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. Utah Income and Losses. Like lotteries state taxes on food amount to a tax on the poor.

Now is the time to take action to repeal the states unfair sales tax on food. Sales and Use Tax. Adams said one of the challenges with repealing the states portion of the food tax is the.

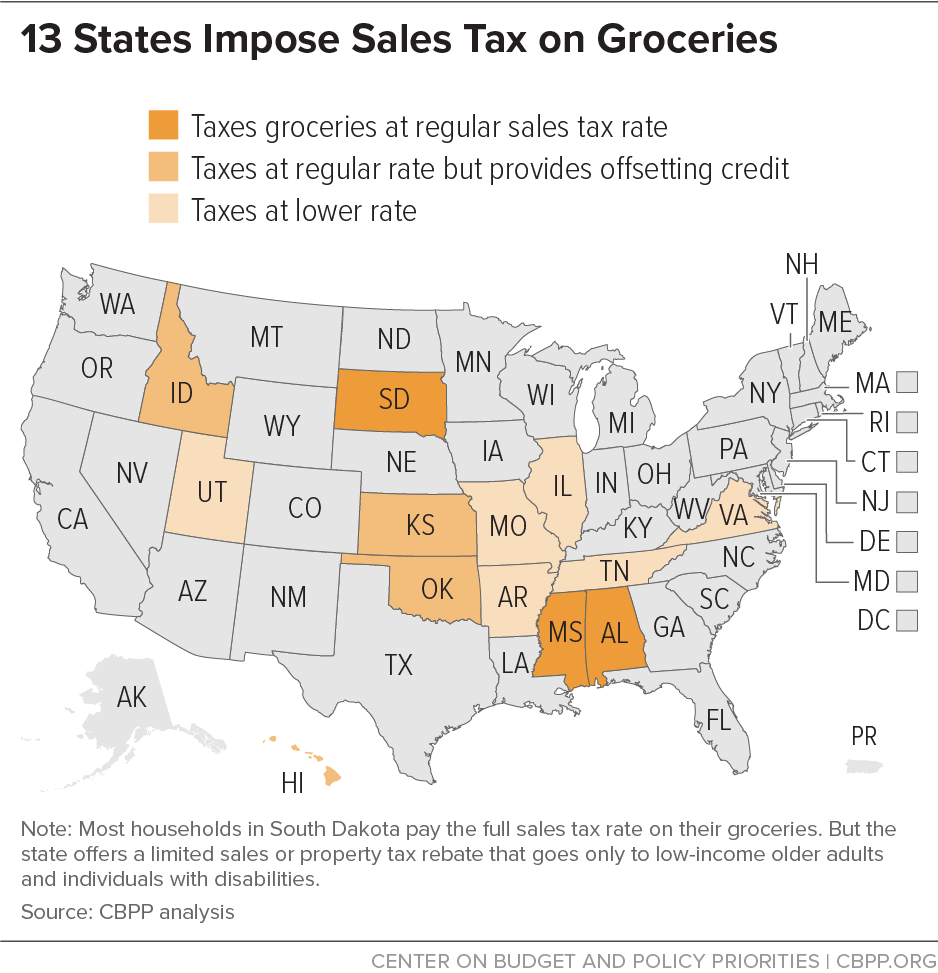

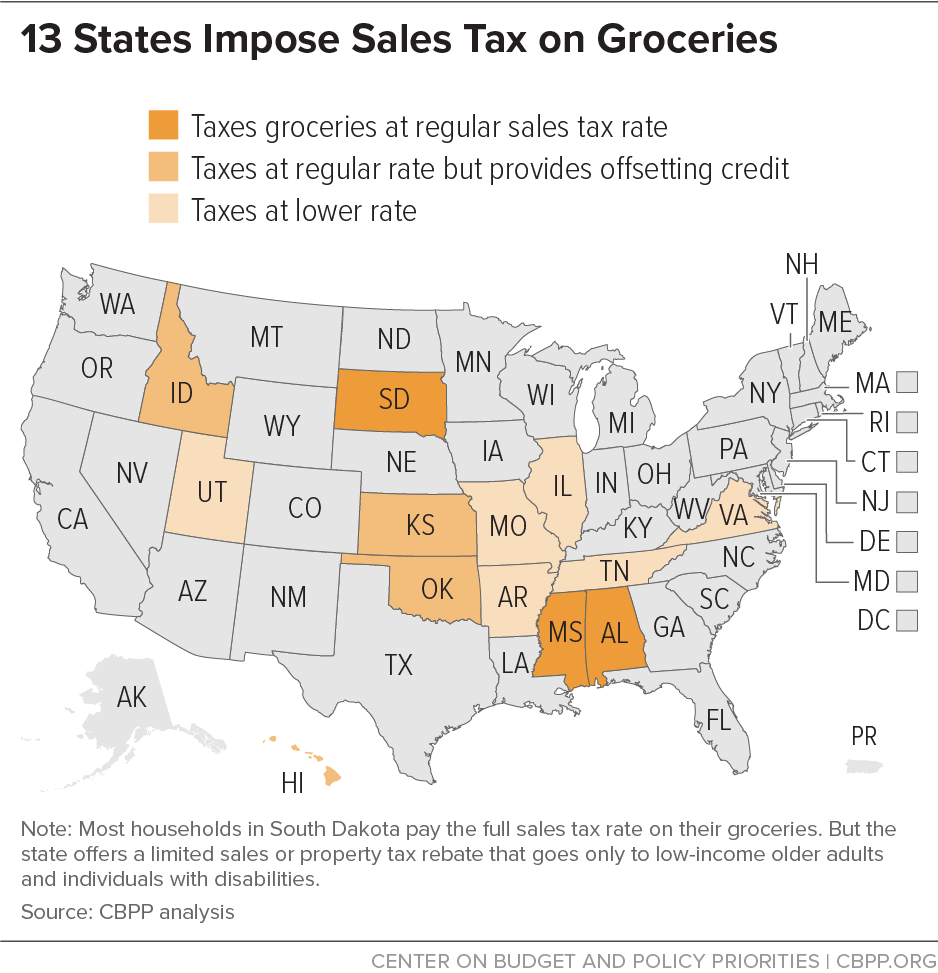

TAP will calculate the credit by multiplying the amount of these sales by the rate in effect as of your filing period. Quick Facts PDF Fiscal Health. California 1 Utah 125 and Virginia 1.

Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. Use Tax Worksheet You may use the following worksheet to calculate your Utah use tax. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

B Three states levy mandatory statewide local add-on sales taxes. The tax on grocery food is 3 percent. Name Address SSN and Residency.

Both food and food ingredients will be taxed at a reduced rate of 175. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. The state can afford to let Utah families keep this portion of their hard-earned incomes.

Rosemary Lesser D-Ogden talks about HB165 and HB203 which both aim to eliminate the states sales tax on food during a press conference outside of the Capitol in Salt Lake City on Tuesday Feb. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Utahns Against Hunger calculated the impact of the food tax hike for a family of four two adults and two school-age children spending 15030 a week on food under the USDAs low-cost food plan.

Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families. Used by the county that imposed the tax. 53 rows a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

Because my taxable income was below the federal standard deduction I end up paying zero state income tax. Whether the tax rate is 495 or 485 does not matter in my case. Back to Utah Sales Tax Handbook Top.

Grocery food does not include alcoholic beverages or tobacco. Feb 22 2022 0938 AM MST. Workers who handle food including temporary event workers are required to obtain a food handlers.

The basic in-state meal allowance for a 24-hour period of travel is. The state currently earns close to 149 million from its 175 sales tax on food. Utah lawmaker Rosemary Lesser is leading the cause to eliminate sales tax from food purchases.

2022 Utah state sales tax. Residential fuels included in line 7. Theres a 175 tax on unprepared foods like what you would buy in.

Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. Enter Tax Line 25. Utah ABC4 Utah legislators are considering putting an end to state food taxes once and for all.

I suspect many other low-income people like seniors on Social Security also are below the standard deduction and would also receive no benefit from this tax cut. TAP will total tax due for you. Feb 22 2022 0929 AM MST.

Judy Weeks Rohner and activists have gathered at Utah State Capitol to urge legislators to pass HB. Enter sales of electricity heat gas coal fuel oil and other fuels sold for residential use included in line 7. State State General Sales Tax Grocery Treatment.

Or to break it down further grocery items are taxable in. 203 a bill that would remove what Rohner. See Pub 25 Sales and Use Tax for more information.

Utah has recent rate changes Thu Jul 01 2021. According to the US. File electronically using Taxpayer Access Point at taputahgov.

On Tuesday Utah State Rep.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Boondocks Food Fun Welcome Boondocks Utah Travel Utah

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

How Do State And Local Sales Taxes Work Tax Policy Center

The New Cacfp Meal Requirements For Childcare Made Easy Pork Roast Meals Cooking

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Utah Sales Tax Small Business Guide Truic

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Mapsontheweb Infographic Map Map Sales Tax

Sales Tax On Grocery Items Taxjar

States With Highest And Lowest Sales Tax Rates

Tax Services Tax Services Income Tax Return Accounting Services

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)