how to answer are you exempt from federal withholding

On the line for Federal enter 99 and then save the record. Next add in how much federal income tax has already been withheld year to date.

Am I Exempt From Federal Withholding H R Block

Line 6 - Additional amount to be withheld - will be blank.

. If you would like to find more information about United States Tax and Internal Revenue Service IRS visit the official site IRS Website at wwwirsgov. In some cases you may be able to claim to be exempt from federal withholding. If you claim exempt no federal income tax is withheld from your paycheck.

You owed no federal tax in 2019 and. The amount withheld depends on. Then complete Steps 1 a 1 b and 5.

If you do this your employer wont withhold federal income taxes from your paycheck. August 17 2021 by Kevin E. You need to indicate this on your W-4.

Uncheck the box for Federal Income Tax IMPORTANT READ NOTE BELOW When you uncheck that box you get a warning message that Form 941 and W2 forms will be affected. You will likely expect to owe no federal tax in 2020 and you wont have to file a federal income tax return if your income is below the filing requirement for your age filing status and dependency status. Generally the only way you can be exempt from withholding is if two things are true.

To claim exemption from withholding write exempt on your W-4 in the space below Step 4c. One employee is exempt from state withholding military spouse. If you can be claimed as a dependent on someone elses tax return you will need an estimate of your wages.

Under the Federal tab you can select Dont Withhold in the Filing Status drop-down. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. Then complete steps 1a 1b and 5.

To claim an exemption you must complete only lines 1 2 3 4 and 7 and sign the form to validate it. The appearance of the Internal Revenue Service IRS visual information does not imply or constitute IRS endorsement. Writing this will guarantee that withholdings are not taken from your future paychecks Your exemption for 2019 expires February 17 2020.

How do I make sure those wages do not show up as State Wages on the W2. Line 5 - Total number of allowances - will be blank. Information Youll Need Information about your prior year income a copy of your return if you filed one.

If the employee is claiming an exemption heres how the W-4 form should look. And thanks for choosing Sage. Choose the Employee ID and go to the Withholding Info tab.

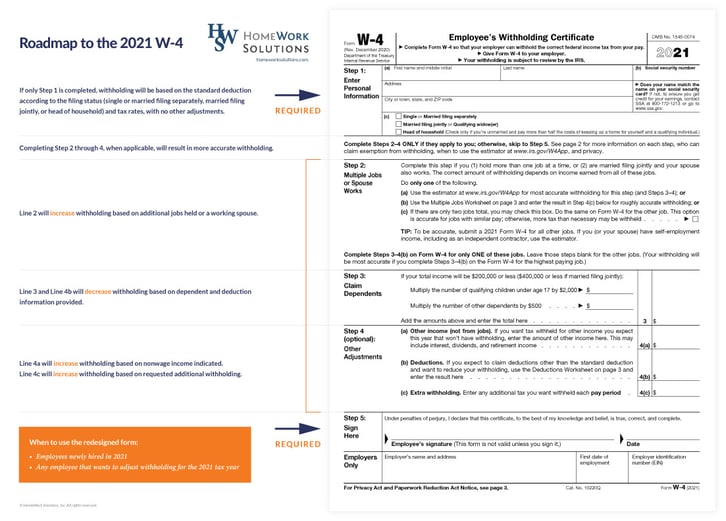

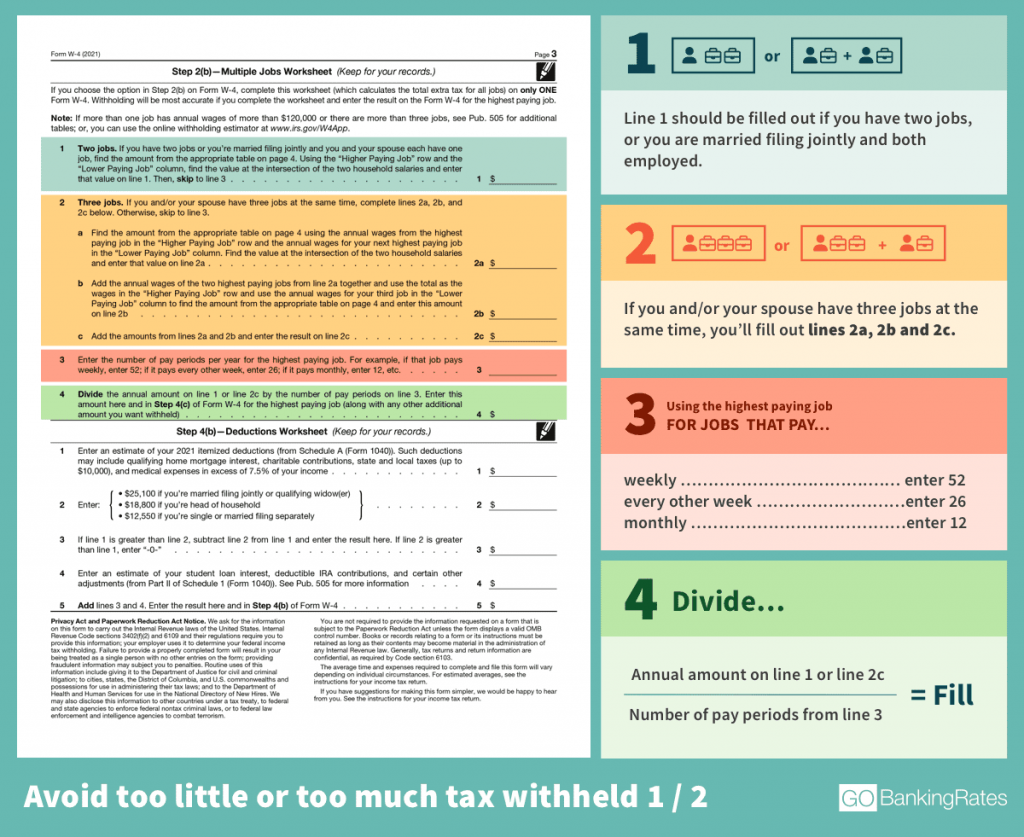

If you are exempt from withholding you are exempt from federal withholding for income tax. The steps to this article can be found on KB 10699. Three types of information an employee gives to their employer on Form W4 Employees Withholding Allowance Certificate.

Dont complete any other steps after that. Click Taxes from the right portion of the window. You may owe taxes and penalties when you file your 2020 tax return.

You will need to submit a new Form W-4 by February 16 2021. Do not complete any other steps. Answers 1 answer Subscribers 110 subscribers Views 3206 views Users 0 members are here.

Go to the Employees menu click Employee Center. You may use Form W-4 to claim exempt from withholding if you meet the following conditions. This means you dont make any federal income tax payments during the year.

To claim exemption from withholding certify that you meet both of the conditions above by writing Exempt on Form W-4 in the space below Step 4 c. This total represents approximately how much total federal tax will be withheld from your paycheck for the year. You expect to owe no federal tax in 2020.

If you want to claim complete exemption from withholding you still need to file a W-4. The easy-to-use IRS Tax Withholding Estimator is on the IRS website. Either the single rate or the lower married rate.

The amount of income earned and. Had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. IRS Income Tax Withholding Assistant.

Click the Next button until you get to the Taxes screen. You got a refund of all your federal income tax withheld last year because you had no tax liability and You. Thats where having your previous tax documents and last pay stub comes in.

Employee is not exempt from Federal so the wages need to show there. In Box 7 write EXEMPT. Make sure to give your completed W-4 to your employer.

Line 7 - The claim of exemption - will show the word Exempt. From the left menu of the Edit Employee window select Payroll Info. This interview will help you determine if your wages are exempt from federal income tax withholding.

Go to the State tab and do the same thing. An estimate of your income for the current year. Number of withholding allowances claimed.

If you are shown as exempt from federal taxes it means your employer does not withhold any federal tax from your paycheck. To use it you answer a series of questions about your filing status dependents income and tax credits. 0 JSelemani over 7 years.

One may claim exempt from 2020 federal tax withholding if they BOTH. How withholding is determined. Double-click on the employees name.

You can tell your boss how much money to withhold by filling out a W-4 form. To make an employee exempt from Federal taxes go to Maintain Employees and Sales Reps.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

W 4 Form Basics Changes How To Fill One Out

Are Social Security Taxes Deductible From Taxable Income Sapling Small Business Tax Federal Income Tax Tax Help

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

A Beautiful Infographic To Share The Similarities And Differences Of Banks And Credit Unions Infographic Credit Union Credit Repair Services Credit Repair

New W4 For 2021 What You Need To Know To Get It Done Right

How To Fill Out A W 4 A Complete Guide Gobankingrates

Taxable Equivalent Yield Taxable Vs Tax Exempt Yields Www Wealthmg Com Wealth Management Financial Calculators Learning Centers

Checklist 7 Essential Elements Of Email Design For Retailers Constant Contact Email Marketing Template Email Design Responsive Email Template

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

Understanding Your W 4 Mission Money

Printable Local Ayso Seeking Sponsors Menifee 247 Basketball Fundraising Letter Fundraising Letter Proposal Templates Sponsorship Proposal

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)